Many retirees woke up in January, looked at their bank account, and saw less money in there than they expected. Scrolling through the payments, they noticed that their payment from their Life Income Fund (LIF) account was noticeably lower than it was only a month prior. What happened? Where did that money “go”?

Let’s start with the basics. LIFs are a unique instrument for retirement that are formed out of former pension money. When you leave an employer with a pension, for a new job or to retire, you’ll often be given the choice to commute the lump sum value of your pension into a self-managed account. This account is typically called a Locked-in Retirement Account (LIRA) or a Locked-in Retirement Savings Plan (LRSP). These accounts are eventually converted into a LIF (or an annuity) when you’re ready to start receiving an income.

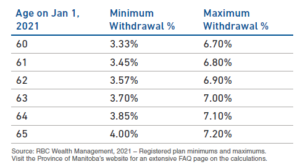

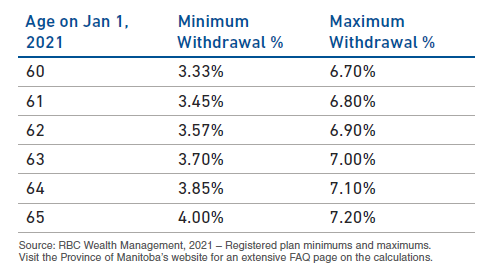

In an effort to keep pensioners from running out of pension funds in retirement, legislators have imposed rules on how much money can be paid out of a LIF account in a given year. There is a legislated minimum that MUST be paid, a legislated maximum that CAN be paid, or you can pick a number in between. The minimums and maximums are most commonly calculated with a simple formula, based on your age at the end of the previous year- the value of your LIF account on December 31st at midnight – and a formula table set out by the government. Here’s a sample of what that looks like in Manitoba:

For a 65 year-old LIF recipient with $300,000 in their account at the end of 2020, they can take an income somewhere between $12,000 (4.00%) and $21,600 (7.20%) in 2021, based on this calculation.

The unique trigger that impacted many LIF recipients in 2021 is a secondary calculation of LIF maximum payments. In Manitoba, your LIF maximum is the higher of the formula above OR the prior year’s investment earnings plus 6% of any new money transferred into the LIF. This nuance meant that pensioners’ 2020 payments were likely buoyed by the big market year that was 2019.

In 2019, the Toronto Stock Exchange (TSX), Canada’s main stock index, rose by about 19%. If your LIF had significant exposure to this index, you may have earned a nice return on your money, which lead to a higher LIF maximum payment in 2020 than you otherwise would’ve received. Instead of the normal, table calculation, your 2020 payments may have been issued based on 2019’s investment performance.

So where did your LIF payment “go”? It hasn’t truly gone anywhere; it’s just returned back to a standard table calculation after being a year removed from hot market performance. What’s the takeaway from this fluctuation? Don’t set up your retirement plans to count solely on a LIF maximum payment! Consider using strategies that bake flexibility into your plans, like unlocking part of your pension or saving in other account types to supplement your retirement income. If you need some help understanding the risks of your pension strategy, consider reaching out to a professional to create game plan that doesn’t catch you off guard!

Recent Comments