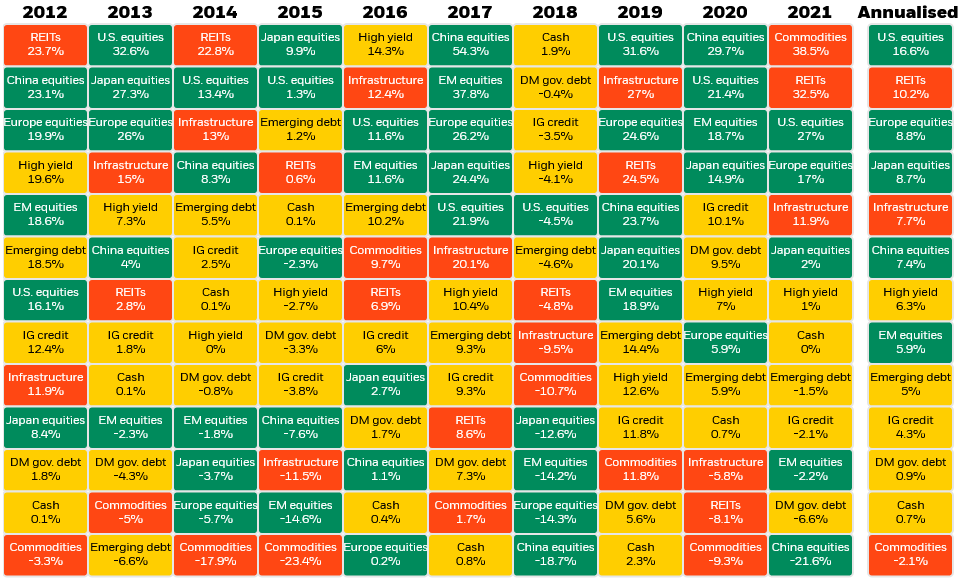

When I was in university, I had a professor put an Asset Class Return Map like this one up on the projector. He said, “if you can spot the pattern, you’ll get to retire in the Bahamas before you’re 25.” The last time I checked, there’s still six feet of snow outside my window instead of palm trees; but the point of that lesson still strikes home. Trying to pick the “best” asset class for the upcoming year is impossible. There is no pattern and pretending there is will likely do more harm than good.

What is an investor supposed to do then if you can’t predict the future? How can we make our money work for us in a (reasonably) predictable way?

Start With The “Other Stuff”

Getting the “best” return on your investment is only a small piece of your overall investing puzzle. There are other, larger factors that have a much more significant impact on your outcome, like:

- Your time horizon,

- Your contribution rate,

- Taxation

The longer your time horizon to keep your money invested, the more the power of compounding interest can work in your favour. An investor who deposits $100,000 and earns 5%, annually, for the next decade will have $162,889.46 in their account. If that same investor waits 25 years, they’ll have $338,635.49!

Investors who contribute more dollars will naturally fare better than investors who are able to contribute less. A person who invests $100/mth will have 10x less at the end of a timeframe than the investor who is able to set aside $1,000/mth. Earning a huge investment return on a negligible amount invested doesn’t put much of a dent in achieving your goals.

One of the biggest detractors from investment performance is income tax. Manitoba has a combined federal & provincial bottom tax bracket of 25% and a top tax bracket in excess of 50%! If you’re earning taxable returns on your investments, you could easily see 25-50% of your profit go out the door to CRA if not structured correctly.

If you have a short time horizon, little money to contribute and aren’t tax savvy with your portfolio, it won’t matter what investment you pick! You’re setting yourself up for failure from the start.

Work Out Your Risk Tolerance and Set Reasonable Expectations

Picking the “best” investment sounds great on paper… but what if that investment makes 50% this year and loses 50% next year? Could you handle that kind of roller coaster ride? If you’re losing sleep over your investment performance, then you’re not using the right risk tolerance for you. It’s perfectly OK to let your emotions guide your initial investment allocation since you can adjust over time!

Once you know the level of risk you’re comfortable with taking, you need to set a reasonable, long-term expectation for the results. If you’re an incredibly cautious investor, with no appetite for risk, but expect your money to double every six months, you’re in for a rude awakening! The Financial Planning Canada Standards Council publishes an annual report on what a reasonable return should look like for given risk tolerances. This is a great starting point for setting your own expectations.

Now You Can Pick Your Asset Allocation

Asset Allocation is the primary driver of a portfolio’s returns. A study from Brinson, Hood and Beebower demonstrated that more than 90% of a portfolio’s returns can be attributed to the asset allocation. Picking a diversified mix of assets that suits your expectations, risk tolerance, tax plans and objectives is at the end of the process. There are countless differing opinions on what an ideal allocation should look like; you can build your own or outsource the work to an investment manager.

Individual security selection and timing of your investments attribute < 10% to your portfolio’s return. Instead of spending countless hours trying to “find the pattern” and beat the system, you’re better off to simply diversify your holdings across companies, sectors, and geographies, while staying true to your asset allocation. Diversification reduces the risk that any one bad company, bad sector, or bad geo-political decision will ruin your portfolio.

Trying to get the “best” return each year is far more likely to be a futile effort than a major difference-maker in your investing success. Time spent on the bigger picture items, that you can influence the outcome on, has a far, far more material impact on your results! If you follow those steps, you’ll find there’s more than one way to get to the Bahamas.

Recent Comments