The last few years have been tumultuous for North American stock markets. March 2020 was one of the sharpest drops in history and, since then, the major indices have rebounded and hit record highs. These rapid changes in equity and bond markets can cause problems for do-it-yourself investors or those whose advisors are slow to react. Chief among them: Portfolio Drift.

What Is Portfolio Drift?

It’s a phenomenon where the different holdings in a portfolio, growing at different rates, can unintentionally alter your asset allocation.

That’s a lot of jargon in one sentence. To illustrate better, let’s look at a simplified example:

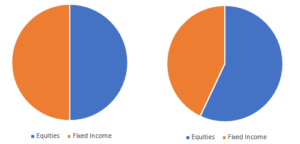

Assume Judy has $100,000 in her investment account and, as a balanced investor, she wants 50% to be in bond holdings and 50% to be in equity holdings. After a while, perhaps her bonds have grown in value from $50,000 to $52,000 but her equities have grown from $50,000 to $70,000. Now she’s no longer in a 50/50 split, but rather in a 43/57 allocation instead.

What’s The Harm?

Judy, simply due to market movements, has had her portfolio become much riskier due to portfolio drift. Should equity markets lose money in the future, she’ll be hit much harder with 57% of her holdings in equities than she would be at 50%.

Correcting this drift, in the Judy example, is relatively easy. She rebalances by selling some of her equities and buying some more bonds. In real world scenarios it can be a little trickier when portfolios consist of several holdings (see example below). Rebalancing also requires you to factor in potential fees or taxation in the form of capital gains and losses.

What Should You Do?

Reviewing your investments on a routine basis for portfolio drift is a great habit to build. You’ll naturally be “selling high” on holdings that have performed above average and “buying low” on holdings that have lagged; all while keeping your portfolio in line with your desired level of risk. If you’re at or near retirement, regular rebalancing is even more critical in being defensive against market drops!

If you haven’t looked at your investment portfolio for strategic rebalancing in a while, now is the perfect time to do so. The dramatic market movements over the past few years has put many accounts out of line with their owner’s objectives and can often be solved with minimal effort. Moral of the story: don’t let portfolio drift disrupt your retirement plans!

Recent Comments