by Thomas Johnson

Most Manitobans are familiar with the recent boom in housing prices over the last several years. If you’re fortunate enough to be a homeowner as you enter retirement, this is likely the most real estate equity you’ve had in your lifetime! But how do use that equity to your advantage in retirement? Should you rely on the value of your home as part of your financial plans?

A Quick Word on Tax

When talking about your primary residence (the place you spend most of the year), you will likely qualify for the principal residence exemption when you sell or bequeath your house! That means the appreciation in value that occurs, while your home is your principal residence, is exempt from income tax.

You should always confirm with your Accountant the specifics to your situation. If you’ve owned multiple properties simultaneously or been in the business of flipping houses for a profit, the exemption may be less cut-and-dry.

Ways To Access Equity in Real Estate

- You can sell your house. This is the most straightforward option. You sell your residence, collect the proceeds, and invest the balance in a manner that contributes to your retirement income. The biggest considerations are: the costs to sell, the costs for where you’ll live next and the after-tax return you can expect on your investments.

- You can borrow with a Home Equity Line of Credit. Assuming you owe very little (or nothing at all) on your mortgage, you may be eligible to open a low-cost line of credit against the equity in your house. When you borrow, the proceeds are tax free, meaning they won’t impact your taxable income or government benefits. The biggest considerations with a line of credit are: your bank’s willingness to lend, the interest rate on the loan, and the requirement to make repayments towards the principal.

- You can take a Reverse Mortgage. Similar to the home equity line of credit, a reverse mortgage provides a negotiated, lifetime stream of income in the form of a loan against your house. The loan is paid off when you pass away or sell your home, so there’s no requirement to repay out of your cash flow. The biggest considerations are: the payment amount, the interest rate, and your estate planning intentions.

Should We Plan to Use Our Equity?

Unfortunately, the answer to this question is “it depends.” Everyone needs somewhere to live. Therefore the cost of shelter is going to be part of your retirement plan naturally.

If your mortgage is paid off and you are living in your “forever home” then I typically don’t account for its’ sale or leveraging. The value of your home has no impact on your income if it’s never going to be converted to cash. If your retirement can be successful with a low cost of housing and without using home equity, consider the asset to be a bonus or fallback plan.

If you feel like your house is “too big” for your retirement years and downsizing is in the future, we absolutely need to include the sale in your retirement projections. The surplus generated from the sale, and the cost of the new place, will play an important role in your retirement success.

If you’re entering retirement with restricted income (only pension income, CPP and OAS) or qualifying for the Guaranteed Income Supplement (GIS), your home’s equity is also a big factor in your plans. The tax-free nature of its’ sale or leveraging can make all the difference in hitting your lifestyle goals without sacrificing key benefits.

Evaluating the equity in your home and how to spend it in retirement can be tricky. There’s no one right answer for all situations. A good Financial Advisor will be able to illustrate the effects of downsizing or leveraging your home in retirement. Knowing what’s needed (or not needed) to fulfill your retirement plans will help you unlock the most from your home!

by Thomas Johnson

For my clients who are approaching retirement, the conversation around de-risking their investment portfolio is a certainty. “When do we stop investing?” “Should we be out of the markets?” These kinds of questions are completely natural.

Having lived through the drastic market crashes of 2001, 2008, and 2020, most Canadians vividly recall horror stories of retirees forced into rejoining the workforce as their nest eggs were decimated overnight. Nobody wants that to happen to them, but is the answer really to avoid equities all together?

The Impact of Early Losses

When conducting financial modeling, the early years of retirement are key. Losing a significant portion of your principal off the bat makes it more challenging to recover. Using an oversimplified example:

10% Loss in Year 1

| Year |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

| Start of Year

Value |

$100,000 |

$80,000 |

$74,000 |

$67,700 |

| Gain (Loss) % |

(10%) |

5% |

5% |

5% |

| Gain (Loss) $ |

$10,000 |

$4,000 |

$3,700 |

$3,385 |

| Income Withdrawal |

($10,000) |

($10,000) |

($10,000) |

($10,000 |

| End of Year Value |

$80,000 |

$74,000 |

$67,700 |

$61,085 |

10% Loss in Year 4

| Year |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

| Start of Year

Value |

$100,000 |

$95,000 |

$89,750 |

$84,237 |

| Gain (Loss) % |

5% |

5% |

5% |

(10%) |

| Gain (Loss) $ |

$5,000 |

$4,750 |

$4,487 |

($8,424) |

| Income Withdrawal |

($10,000) |

($10,000) |

($10,000) |

($10,000 |

| End of Year Value |

$95,000 |

$89,750 |

$84,237 |

$65,813 |

Even though both scenarios had the same return percentages, the retiree whose loss came in year four fared nearly 8% better in the same time frame! There is inherit value to playing it safe in the early years of your retirement and mitigating initial losses.

The Case for De-Risking

If you are expecting to draw down on your retirement accounts within the next 5-7 years, you should definitely re-evaluate your risk tolerance. As illustrated above, taking a significant loss as you switch from accumulation mode to decumulation mode can be harmful to your plans. If your retirement can be funded with lower risk, and potentially lower returning holdings, why not play it safe? When you can afford to take less risk, doing so increases your likelihood of a successful retirement!

Why You (Probably) Still Need Equity Exposure

As with all things finance, your decisions come with tradeoffs. Taking less market volatility risk with your portfolio introduces new risks; chief among them, inflation and longevity risk.

The risk of inflation hasn’t been this evident in several decades. As the cost of living goes up, your retirement income will need to rise accordingly to avoid a drop in lifestyle. If your retirement portfolio is too conservative, earning less than inflation, you could find yourself eroding too much principal to be sustainable.

Longevity risk is the risk of outliving your money. If your portfolio doesn’t earn a high enough return to sustain itself over 30, 40, or even 50+ years, you could wind up with no assets left.

How To Invest More Wisely

There are countless strategies you can implement to reduce market risk as you begin retirement, without falling victim to inflation and longevity risk. You could consider an income strategy using a “safety bucket”, guaranteeing part of your fixed income with a life annuity, you can diversify your holdings, take a glidepath approach, and many more.

The single best way to reduce risk is to have a conversation with your Financial Advisor. Before you can determine HOW to de-risk, you need to understand HOW MUCH risk you need to meet your goals. Retirement becomes much simpler when your portfolio matches your objectives.

by Thomas Johnson

If you’re approaching retirement, or even in retirement, you will have some money decisions around large lump sums. When you sell a business, take control over your pension or group RRSP, downsize your home, or even inherit assets, you have choices to make.

One of the most fundamental decisions for investing lump sums is figuring out “when” to convert that cash into investments. Is there a “best” day to get into the market? Can you time out the right moment to deposit proceeds into your retirement portfolio?

Can I Time the Market?

The short answer is “no.” The long answer is “almost certainly no.” Look at historical returns over any given year and you’ll see predicting outcomes is downright impossible. Narrowing that window to a particular month, week or day is even harder still. At best, your odds of buying on a “good market day” vs. a “bad market day” are near 50/50. Do you want to start your entire retirement nest egg off on a coin flip?

When Should I Invest?

When it comes to investing large lump sums, a good process is key to mitigating market risk. If you know that investing on one particular day is equivalent to a coin flip, heads you win and tails you lose, do you take that gamble? Or would you rather tilt the odds in your favour by, say, taking more turns?

Instead of only one try to get it right, what if you split the funds into smaller chunks and take 5, 10, or even 20 tries? Sure you’re likely to get “tails” on some of those days, but you’re also offsetting by getting “heads” on the others. This is the fundamental nature behind the investing strategy of dollar-cost averaging. Hedge yourself against market timing risk by systematically moving out of cash over time.

How Do I Implement Dollar-Cost Averaging?

Dollar-cost averaging is very simple to implement. Most investors have been doing so without knowing it their entire working careers. When saving monthly or bi-weekly into your RRSP, work pension, or any other account, you’re using dollar-cost averaging. Most people just don’t think to apply the same principles to lump sums. Instead preferring to get it out of their hands as quickly as possible so the cash doesn’t burn a hole in their wallets!

You can work out a dollar-cost averaging plan with your Investment Advisor by apportioning out your lump sum into equal installments, rolling cash into your portfolio on pre-determined dates. For example, you may split $100,000 into 10 equal deposits of $10,000, scheduled to invest on the 15th of each month. This calculated approach will get all of your funds invested over time, without the stress or risk that you timed the market poorly with the entire amount.

Navigating the nuances of lump sums can be tricky. Take the time to map out a systematic approach to investing those assets and you can rest easy that you’ve moved the odds in your favour! There are plenty of other considerations, like taxation, portfolio construction, and withdrawal strategy, but at least your initial deposit won’t be relying on a coin flip!

by Thomas Johnson

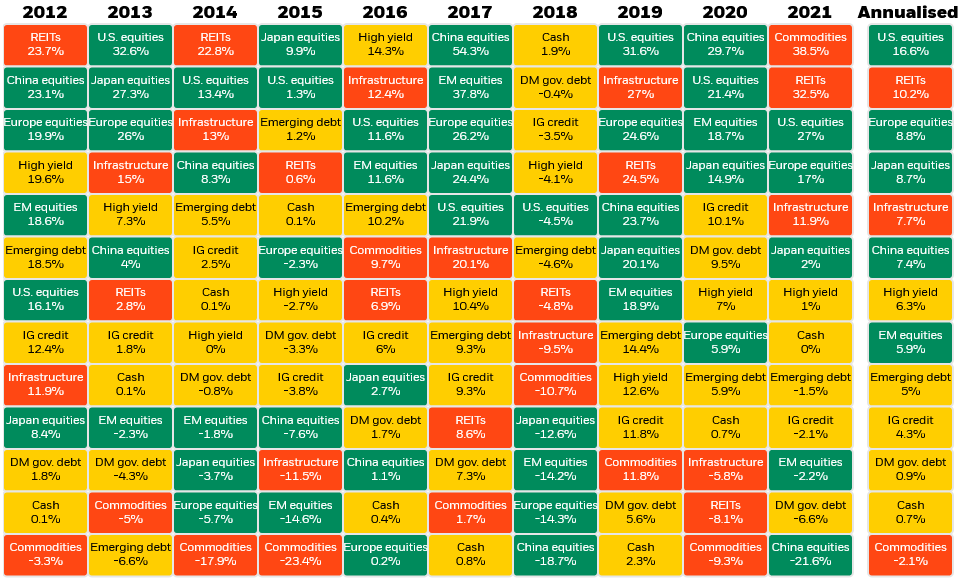

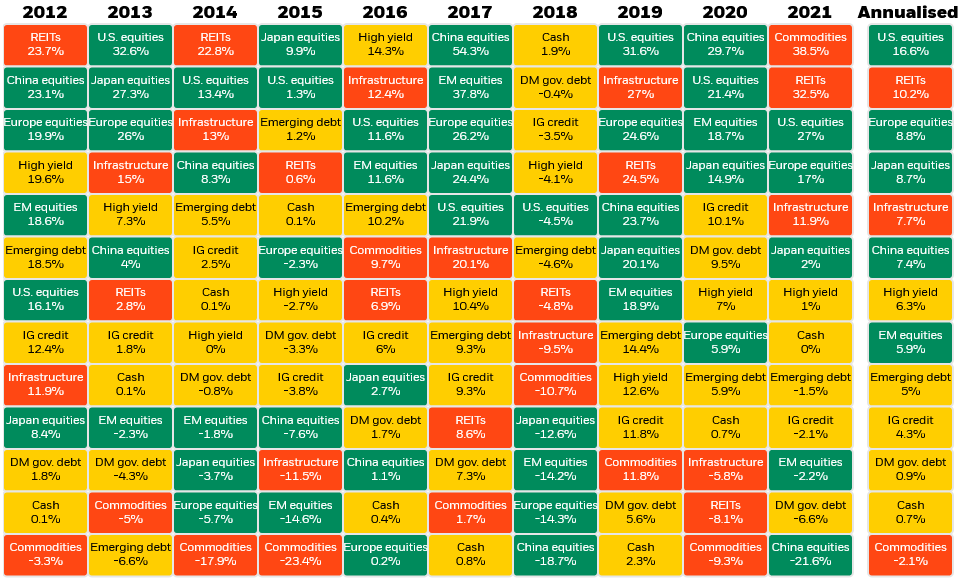

When I was in university, I had a professor put an Asset Class Return Map like this one up on the projector. He said, “if you can spot the pattern, you’ll get to retire in the Bahamas before you’re 25.” The last time I checked, there’s still six feet of snow outside my window instead of palm trees; but the point of that lesson still strikes home. Trying to pick the “best” asset class for the upcoming year is impossible. There is no pattern and pretending there is will likely do more harm than good.

What is an investor supposed to do then if you can’t predict the future? How can we make our money work for us in a (reasonably) predictable way?

Start With The “Other Stuff”

Getting the “best” return on your investment is only a small piece of your overall investing puzzle. There are other, larger factors that have a much more significant impact on your outcome, like:

- Your time horizon,

- Your contribution rate,

- Taxation

The longer your time horizon to keep your money invested, the more the power of compounding interest can work in your favour. An investor who deposits $100,000 and earns 5%, annually, for the next decade will have $162,889.46 in their account. If that same investor waits 25 years, they’ll have $338,635.49!

Investors who contribute more dollars will naturally fare better than investors who are able to contribute less. A person who invests $100/mth will have 10x less at the end of a timeframe than the investor who is able to set aside $1,000/mth. Earning a huge investment return on a negligible amount invested doesn’t put much of a dent in achieving your goals.

One of the biggest detractors from investment performance is income tax. Manitoba has a combined federal & provincial bottom tax bracket of 25% and a top tax bracket in excess of 50%! If you’re earning taxable returns on your investments, you could easily see 25-50% of your profit go out the door to CRA if not structured correctly.

If you have a short time horizon, little money to contribute and aren’t tax savvy with your portfolio, it won’t matter what investment you pick! You’re setting yourself up for failure from the start.

Work Out Your Risk Tolerance and Set Reasonable Expectations

Picking the “best” investment sounds great on paper… but what if that investment makes 50% this year and loses 50% next year? Could you handle that kind of roller coaster ride? If you’re losing sleep over your investment performance, then you’re not using the right risk tolerance for you. It’s perfectly OK to let your emotions guide your initial investment allocation since you can adjust over time!

Once you know the level of risk you’re comfortable with taking, you need to set a reasonable, long-term expectation for the results. If you’re an incredibly cautious investor, with no appetite for risk, but expect your money to double every six months, you’re in for a rude awakening! The Financial Planning Canada Standards Council publishes an annual report on what a reasonable return should look like for given risk tolerances. This is a great starting point for setting your own expectations.

Now You Can Pick Your Asset Allocation

Asset Allocation is the primary driver of a portfolio’s returns. A study from Brinson, Hood and Beebower demonstrated that more than 90% of a portfolio’s returns can be attributed to the asset allocation. Picking a diversified mix of assets that suits your expectations, risk tolerance, tax plans and objectives is at the end of the process. There are countless differing opinions on what an ideal allocation should look like; you can build your own or outsource the work to an investment manager.

Individual security selection and timing of your investments attribute < 10% to your portfolio’s return. Instead of spending countless hours trying to “find the pattern” and beat the system, you’re better off to simply diversify your holdings across companies, sectors, and geographies, while staying true to your asset allocation. Diversification reduces the risk that any one bad company, bad sector, or bad geo-political decision will ruin your portfolio.

Trying to get the “best” return each year is far more likely to be a futile effort than a major difference-maker in your investing success. Time spent on the bigger picture items, that you can influence the outcome on, has a far, far more material impact on your results! If you follow those steps, you’ll find there’s more than one way to get to the Bahamas.

by Thomas Johnson

Have you ever heard of a lottery winner or professional athlete who went broke after receiving an exorbitant sum of money? According to various news outlets, up to 70% of lottery winners spend it all and former professional athletes are four times more likely than you or I to go bankrupt!

If you’re facing the prospects of a large, lump sum of cash, from selling property, an inheritance, the sale of a business or commuting a pension, how can you avoid the same fate?

Invest Wisely

Where and how you invest your money matters. Whether it’s saving $100 from a paycheque or allocating $100,000 from downsizing your home, the basic principles are the same. Start by assessing your goal for the funds (a.k.a. how will you spend it), the potential for income tax erosion, and your tolerance for risk in your investments.

- Goals Matter. If you need some, or all, of the funds for immediate purchases or debt repayment, your investing decisions will be very different than someone who plans to use the funds for lifetime income. Think hard about your goals for these funds as that will be the driver for all other decisions!

- Income Tax Hurts. Are the funds you received already registered or non-registered? Do you have RRSP or TFSA room to shelter investments from taxation? Is your investment selection going to produce highly taxable income? With a top tax bracket over 50% in Manitoba, income tax can quickly erode your newfound wealth.

- Get Comfortable With Investment Risks. There’s a big difference between investing in a diversified stock portfolio and investing in your brother-in-law’s startup business. There’s a big difference in buying real estate and buying GICs. The point is you should understand the risks of your investment choices before your commit your cash to the idea and feel comfortable doing so. If you can’t afford the potential losses, then the potential gains aren’t worth it.

Make a Budget

I know, I know… budgets can be boring! But having a realistic concept of how much you can spend in a particular period of time is vital to making your lump sum last. For example, if you have $100,000 and take $5,000 each year, you can repeat that amount for 25 years if your investments produce a 4% (after tax) annual return. Take out more each year and your resources will diminish faster; take out less and they’ll last longer. You can experiment with your own numbers using any number of online Time Value of Money calculators or by enlisting a Financial Advisor with more complex software.

Stay Accountable

Suddenly having more money at your fingertips than any other point in your life can be daunting. It can be easy to splurge on the kids’ birthdays, a night out on the town with your partner, or on a luxury you’ve long dreamt of. Doing so once or twice probably won’t derail your plans. Doing so repeatedly can become a bad habit for financial stability!

If you have a person in your life to hold you financially accountable, lean on them. Let them in on your goals, your budget and how you’ve invested your money to hit those targets. If you don’t, consider hiring a Financial Advisor to keep you disciplined and on track for your future.

It’s perfectly natural to feel anxiety or stress when a lump sum of cash enters the picture. No one wants to mess it up and become another statistic! Making good decisions, the right decisions, all starts with having a process and framework in mind. Invest wisely, work within a budget and stick to it! You’ll be sure to make it last.

Recent Comments