When Should You Hire A Retirement Advisor?

I’ve met with many Manitobans who have gone decades of adult life without hiring a Financial Advisor. Some haven’t felt the need (minimal debt and savings, no kids, healthy pension) and a few DIYers simply enjoy researching all things personal finance! No matter the...

When Should I Start My RRIF Payments?

If you’ve ever explored the nuances of Registered Retirement Savings Plans (RRSPs), you may already be aware you can’t own them forever. It is mandatory that all RRSPs be converted into Registered Retirement Income Funds (RRIFs) by December 31st of the year you turn...

Why You Should Save for Retirement, Even With a Pension

It’s common knowledge that many Manitobans work for employers with a defined benefit pension. Teachers, nurses, government employees and MB Hydro workers make up a significant portion of our workforce! While having an employer-funded pension is a great start to your...

Why Is Tax Planning Important?

“Why should I do tax planning? I already have an accountant doing my tax returns.” I hear these kinds of phrases all the time when working with clients. By-and-large, there is a great deal of misconceptions in the financial services space around tax planning vs....

Incorporating A Business In Retirement Plans – Part 2

Last week, we went over the basics of planning for the eventual exit from a business. If you haven’t read that post, I highly recommend starting there! A successful transition out of a business is a big win for retirement planning. This week is all about the other,...

Incorporating A Business In Retirement Plans – Part 1

Business owners in Manitoba have several extra layers of complexity when it comes to retirement planning. How do you factor a business into the equation? Pension projections or investment withdrawals pale in difficulty to the tax and valuation challenges of business...

What Does It Take To Save $1 Million?

Having a million dollars sitting in your bank account sounds pretty nice, right? My personal opinion is that the majority of Manitobans would feel pretty comfortable in their retirement plans with that kind of dollar value attached to their names. Short of winning...

Why Is Borrowing So Hard in Retirement?

Financing purchases is something that becomes second nature to us over our lifetime. Between buying homes and vehicles, perhaps a business or cottage, or even doing renovations, you’ve likely applied for credit numerous times over the years. What tends to surprise...

Trimming Your Budget Before You Retire

The biggest driver of retirement success is not necessarily how much you’ve saved. Having a big bank account is a great start; but can be quickly eroded if you lose control of your living expenses. Instead, focusing on how much you spend in retirement can have a far...

A Beginner’s Look at Gifting to Grandkids

Let’s be honest, most grandkids wind up very spoiled thanks to their grandparents! Birthdays, holidays, presents, dinners and candy are common expenditures when you’re a grandparent. If you’ve ever thought about giving your grandkids something different, something...

How Much Money Do You Need to Retire?

How much money is “enough” to retire? For such a seemingly simple question, the answer is anything but simple! “Enough” money for one person to retire successfully can be vastly different for another. While I can’t give a single answer that applies for all; I can...

Are RRSPs “Bad” For Retirement?

“My sister/father/neighbour/co-worker told me that RRSPs are ‘bad,’ is that true?” This question has long surprised me in my career because of how often it comes up! Registered Retirement Savings Plans (RRSPs) are a tool in your financial toolkit that, when used...

How To Make your Retirement Savings Last

Almost everyone approaching retirement will, at some point, ask the question: “will I run out of money?” It’s completely understandable to feel this kind of concern. You’ve worked hard to amass resources for your retirement years and returning to the workforce in your...

Make Downsizing Your Home Less Stressful

The vast majority of retirees will, one day, sell their longtime residence in favour of something more conducive to their retirement lifestyle. If you spend summers at the lake and winters snow-birding somewhere warm, maintaining the home you raised your family in...

Reader Beware: Check The Fine Print on Your Statement

I can’t even begin to count how many clients have told me “when I retire, I’m going to get $X per month from my work pension, guaranteed!” However, when we review their statements together, they’re quite surprised to find out the income figure in their minds IS NOT...

What Is A “Meltdown” Strategy?

Often called an “RRSP Meltdown” or a “RRIF Meltdown”, a “Meltdown” strategy is, simply put, a tax and financial planning concept for rapidly liquidating a registered investment account. For example, an individual who redeems a significant portion of their registered...

How To Get More Retirement Income

I think it’s safe to say that every single Manitoban with retirement on their minds is asking the question, “how do I get more income in retirement?” It’s perfectly logical to try and optimize your financial position, squeezing the most money you can out of your...

Beginner’s Guide to Retiring from MB Hydro

As one of our province’s largest employers, Manitoba Hydro hires and retires a tremendous number of individuals every year. It’s no wonder the Crown Corporation is able attract new employees with their flexible work schedules (“Hydro Mondays” are a wonderful thing),...

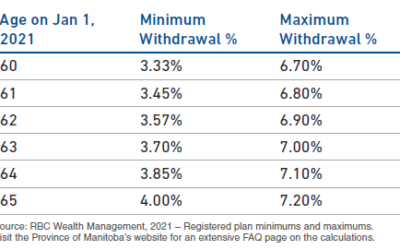

Why Did My Pension Payment Change?

Many retirees woke up in January, looked at their bank account, and saw less money in there than they expected. Scrolling through the payments, they noticed that their payment from their Life Income Fund (LIF) account was noticeably lower than it was only a month...

How to Break the Pension Ceiling

If you’ve ever participated in a Manitoba pension in your working career, you may already know that your income options are limited. Government regulations place restraints on “when” you can access your pension income as well as “how much” you are allowed to access in...

Can I Retire With Debt?

I’ve had many clients who struggle with the idea of retiring with a single dime of debt on their balance sheet. There seems to be this inherent, ingrained notion that all debt is bad debt and it’s impossible to retire successfully when you are still on the hook for...

The “Two Bucket” Approach to Retirement Income Planning

One of the most common idioms when it comes to investing is “buy low and sell high.” It’s a simple notion that can be dreadfully hard to achieve in our retirement years. After all, your retirement investments are likely one of your main sources of income. If you’re...

The Importance of Risk in Retirement Portfolios

When you’ve worked, budgeted and saved for 20, 30, 40 or more years, it’s really hard to look at your life savings and think “I should take a gamble with that money!” After all, your retirement nest egg is meant to carry your family, financially, through the next...

Is an RRSP or a TFSA Better For Your Retirement?

I’m routinely asked by clients whether they should be using Registered Retirement Savings Plans (RRSPs) or Tax-Free Savings Accounts (TFSAs) for their retirement savings. Unfortunately, there isn’t a “one size fits all” answer to that question. The right answer is...

How to Handle Lump Sum Purchases in Retirement

One of the hardest aspects of retirement planning is managing cash flows. In your working years, you’ve likely had relatively consistent pay cheques every few weeks. You’ve had years of practice in lining up your expenses and saving for big purchases and rainy days....

Is Your Estate Plan Up To Date?

A 2018 CTV News poll found that more than 50% of Canadians do not have a will. That means there is a 1-in-2 chance that if you’re reading this, you do not have the most important cornerstone of your estate plan in place. If you do have a will, well done! You’re off to...

What Should A “Practice Retirement” Look Like?

When it comes to preparing for retirement, I often advise clients to get some practice in. When you’ve worked consistently for 30 or 40 years, it’s often hard to truly let go of that career mindset and find new purpose in life. By taking the time to practice...

How to Make Sense of Pension Options

If you’re in the final weeks or months of your working career before retirement, you’ve likely begun to pore over your pension options from your employer. This is often a confusing and daunting task given the plethora of choices available! “Joint, 2/3 to Survivor with...

Should I Insure My Pension?

The idea of insuring a pension seems a little counter-intuitive. Why and how would a person “insure” a source of income in retirement? It may surprise you to know that all pensions are inherently insured and setting your coverage up the right way could pay off BIG...

What’s A LIRA Anyways?

Maybe you’ve looked at an investment statement and never noticed it before. Or maybe your former employer has sent you a letter with it. That strange little acronym that was never talked about at school. Never on display at the bank. "LIRA". What is it and what does...